Contents

- 1 Who Can Start a Small Business in Russia

- 2 Small Business Opportunities in Russia

- 3 Tax Structures for Russian Small Businesses

- 4 Operating a Small Business in Russia

- 5 Learning Russian is Tough but Worthwhile

- 6 Russian Bureaucracy Slows Things Down

- 7 Russian Mentality and Management Styles

- 8 Running a Small Business in Russia Remotely

- 9 Can I Get a Residence Permit in Russia by Opening a Small Business?

- 10 Conclusion

Running a small business in Russia as a foreigner can be quite intimidating if you don’t know what you are doing. But, did you know that Russia is one of the easiest countries in the world to do business? The World Bank puts Russia ahead of Japan and Switzerland at number 28 in the world for ease of doing business. Don’t believe us? Check out the World Bank’s 2020 Doing Business Guide.

A great analogy to running a business in a foreign country is visiting a store in a foreign country and asking to see something from the shelf. You know it’s an awkward and frustrating situation. You just want to ask a couple of simple questions about a product and your hand gestures aren’t getting through. Now, imagine you’re running your own small business in Russia. Naturally, you’d think it’s a hundred times more difficult. On the contrary, running a small business in Russia as a foreigner is likely easier than running a small business in your home country. As a foreigner who doesn’t speak Russian, opening and running your own small business in Russia is very possible and can be quite straightforward if done correctly.

Who Can Start a Small Business in Russia

The short answer is anyone can start a small business in Russia. Any person, Russian or non-Russian, is allowed to establish a fully or partially-owned Russian limited liability company. You may also establish other legal entities regardless of citizenship or even residency status in most instances. That is not the case in many other countries.

For instance, as a foreigner in Europe, you cannot simply show up and establish a limited liability company. You first need to apply for a start-up or founder visa, although many foreigners don’t need a visa to enter Europe as a tourist. On the other hand, Russia is the opposite. Russia requires many foreigners to get a visa to visit the country, however, you are allowed to open a Russian limited liability company without a residence permit. In Russia, you can open a limited liability company on any visa, even a tourist visa! Keep in mind, that opening a small business in Russia doesn’t mean that you have the right to work for your company and start receiving a salary. In order to do that, you do need a work permit and work visa in Russia.

There is a legal entity in Russia with some advantages that we will look at in more detail below, which does require legal residency. It’s called an individual entrepreneur or индивидуальный предприниматель in Russian. Under Russian law, an individual entrepreneur most closely resembles a sole proprietor because you, as the owner, are legally liable for the business with your own personal assets. Therefore, this type of entity requires temporary or permanent residence in Russia. If your long-term goal is to obtain permanent residence in Russia, and you plan on running a small business, registering as an individual entrepreneur is a favorable option. Check out the Expatriant guide to legal residence in Russia for all of the residency options available.

Small Business Opportunities in Russia

Let’s examine Russia in numbers. Russia boasts a population of 145 million people, 12 cities have over 1 million people and 201 cities across Russia have between 100,000 to 1 million people. Russia stretches across 11 time zones and covers one-fifth of the world’s landmass. Whatever your business plans may be, Russia has the potential to support them. The easiest types of businesses to start are cafes and shops. Online internet stores already thrive throughout Russia, especially in the biggest Russian cities. Online businesses providing services to Russians is also an underserved market.

One type of the most promising small business is purchasing or investing in commercial real estate on the first floor of residential buildings before they are completed for the purpose of opening a store, educational center, language school, yoga center, beauty salon, etc. In Moscow, in particular, these residential apartment blocks accommodate thousands of people, so you have many potential clients in the immediate vicinity if you offer something unique.

The opportunities don’t end there. Your small business in Russia doesn’t even need to be geared towards the Russian market. Incoming tourism is continually growing in Russia and more foreign students are looking to spend a semester or longer in the former Soviet Union. To many visitors, Russia is still an unknown and untamed country. Besides focusing on those coming into Russia, there are business opportunities to promote leaving Russia as well. Many Russians wish to study, travel, or invest abroad. Many Russians view the Western world as greener pastures. Consequently, any business dealing with sending Russians abroad has a substantial upside for growth.

On a final note, don’t rule out the option of running a remote business from Russia, especially if you’re already a small business owner. This applies to consultants, freelancers, solopreneurs, entrepreneurs, and any other small business with the ability to perform a significant part of its business remotely. Any income in USD or euro goes a long way with today’s severely devalued Russian ruble. You will find that living on a Western wage from outside of Russia affords you a very comfortable standard of living in Russia. Check out Expatriant’s article on the cost of living in Moscow for more information. Income tax is a flat 13%, which is lower than any Western country, while rent, utilities, local services, local food, and restaurants in Russia are all comparatively inexpensive thanks to economic sanctions, record-low oil prices, and the recent COVID-19 pandemic.

Thinking about starting a business in Russia but don’t know your options? Check out these 4 simple ways you can start a business in Russia.

Tax Structures for Russian Small Businesses

While many countries impose limitations on foreigners doing business in their countries, Russia imposes relatively few restrictions. Over the last 10 years, Russia has come a long way in leveling the playing field for small businesses in Russia. The tax system in Russia has also been overhauled. Although there are multiple tax systems available without restrictions on foreign-owned companies, there are two corporate tax programs, which are part of the simplified tax system that many small businesses prefer to use because they require less paperwork, hence the name.

The first option under the simplified tax system in Russia is a flat 6% tax on gross revenue. If your business has relatively low overhead such as providing services, this tax system makes your life much easier.

Alternatively, if you have high overhead in your small business such as large monthly expenditures on office rent, equipment, materials, and employees, you can elect to pay 15% on net profit.

These simplified tax systems make your life considerably less complicated from a tax reporting perspective. There are no deductions and no need to calculate your tax burden. You either pay a 6% corporate tax on gross revenue or 15% on net profit.

These two options are available for any small businesses with yearly revenue of up to 200 million rubles ($2,697,302).

Operating a Small Business in Russia

If you’ve gotten this far, you’re still wondering about daily operations. “How in the world am I supposed to run a business established in Russia if I don’t speak Russian?” This thought goes through many people’s minds but let’s step back and think about any real functioning and sustainable business. What do they all have in common? Growing businesses have an idea with processes set up to execute on that idea. A business in your home country cannot depend solely on you to operate. It has employees, contractors, and partners. The same goes for small businesses in Russia. The secret to getting over the language barrier is delegation.

Every small business in Russia, regardless of size, needs to officially appoint an accountant and a director who resides in Russia. Fortunately, there are plenty of companies to outsource your accounting for anywhere from 6,000 to 25,000 rubles ($80 – $332) per month depending on the number of transactions and paperwork involved. With the simplified tax systems mentioned above, the average monthly accounting costs for small businesses typically fall between 10,000 and 20,000 rubles ($133 – $265). This includes all reporting and submissions to the tax authorities. As your small business in Russia grows, you will need to have more interaction with your accountant in the form of meetings that would not be covered in these costs.

As for the director, there are a few ways to go about it. Your company can appoint you as the director or hire a local. Appointing yourself as a director means getting a set salary in Russia and being able to work legally. In this case, you need to hire an assistant who speaks English to assist you in daily tasks. This is not necessarily an added expense since your business most likely still needs to fill a secretarial, administrative assistant, or similar role. Fill that role with a candidate who is proficient in English. Qualified candidates are not difficult to come by in Russia and they will cost you less than in the West.

Appointing a local person as the acting director of your company is one option and in some cases the best way to go. Your director reports to you as the shareholder and any other employees, contractors, or partners report to your director. There’s no language issue, assuming the director speaks your language. Finding the right fit can be somewhat challenging, but your foreign-owned business has two major advantages:

- Most candidates prefer to work for a foreign-led company

- Your director’s salary is, on average, significantly lower than in the West

By hiring a few local employees in your Russian small business, you can easily avoid the language barrier. There are no rules that dictate your team must have meetings in Russian. Keep in mind, many Russians at one point or another pay to attend English language courses in order to advance in their career. It’s an advantage for employees to be able to use English at work if you hire locally. As long as you have processes in place for submitting official reports to the Russian tax authorities, a small business can work just as well in Russia as it does outside of Russia.

Advantages of Running a Small Business in Russia

Depending on the type of business you’re running, there are numerous benefits to running a business in Russia. The top benefits for most foreigners are:

- low tax rate

- numerous residency options

- access to resources, including an educated workforce at significantly lower costs than in the West

Since 2014, and for the foreseeable future, the undervalued Russian ruble is a huge advantage if your small business in Russia is bringing in foreign currency. With sizable capital, there are many opportunities with little or even no competition in Russia.

Income Tax

In order to qualify for the 13% income tax rate, you must become a tax resident of Russia by residing 183 days in Russia. There are no regional or city taxes in Russia either, just a flat federal income tax of 13%. This is very low compared to the United States and, obviously, Europe. For US citizens worried about having their income abroad taxed, there’s an incentive to take a salary from your Russian company. You can take advantage of the Foreign Earned Income Exclusion (FEIE), which as of 2020, allows you to exclude $107k per year from your taxable income in the US. Almost all other countries do not tax income earned abroad as they have a territorial tax system instead of a worldwide tax system. In addition to lowering your income tax obligation, there’s a way to minimize employer contributions to the state for foreign employees with highly qualified specialist status so your business expenses drop as well. Let’s Russia has a great guide on how this can be done.

Highly Qualified Specialist Visa

Those hoping to minimize business expenses and income taxes have the option of applying for a highly qualified specialist visa. The highly qualified specialist visa in Russia offers significantly lower bureaucratic obstacles but comes with a requirement that the visa holder earns at least 2,000,000 rubles per year. Before you think that’s a drawback, and it certainly used to be, dust off your calculators. Two million rubles is just $27,068 at the current exchange rate. If the business you establish in Russia can pay you as a director, or any other role, a salary of at least 167,000 rubles per month ($2,260), you can apply for a highly qualified specialist visa.

Why is Highly Qualified Specialist Status so Great?

Here are the main benefits:

- You pay 13% income tax starting from the day you get your work permit (for regular work visa holders, you must pay 30% for 6 months until you become a tax resident in Russia).

- Your business is not required to make social contributions to the Russian government on your behalf as an employee. Social contributions can be as much as 30% with a typical Russian work visa.

- You get a multiple entry work visa for 3 years with the flexibility of traveling in and out of Russia as you please without needing to register for up to 90 days each time you re-enter Russia.

- You also have a simplified path to residency and eventually citizenship should you choose to pursue it. Check out Expatriant’s guide to getting a residence permit by working in Russia.

- Your family members (spouse and children) also get 3-year HQS accompanying family visas.

Let’s Russia has put together a full review of the benefits of the highly qualified specialist visa.

In the event that your Russian business cannot meet the minimum salary requirements for a highly qualified specialist visa, not all hope is lost. Russia has recently expanded the list of professions that provide eligibility to apply for a residence permit after just 6 months and citizenship after 12 months of employment in one of the listed professions. That list now contains 135 professions deemed socially important. There is another list of 80 professions for which a company doesn’t need to apply for special permission if it wishes to hire foreigners. This has simplified the process of recruiting foreigners for many Russian companies.

As we mentioned above, should you choose to hire a team of Russians, you’ll find that most want to work for a company with foreign leadership. This is because some Russian companies cut corners and treat employees unfairly. Russian management differs quite a bit from western management. Russians tend to demand and put lots of pressure on employees to perform. There is also a cultural hierarchy prevalent in Russian management that has a strong accent on power and subordination. Negative or external incentives are regularly used.

Conversely, the western way is to inspire employees and incentivize them internally to perform well. The atmosphere is typically less stressful (not to confuse that with less demanding) in an international company versus a Russian company. Therefore, attracting talent to your company isn’t as challenging and is less costly than in the West.

Disadvantages of Running a Small Business in Russia

As in every situation, there are disadvantages to running a small business in Russia, but in most scenarios, there are options to mitigate these disadvantages. The most noteworthy disadvantages of running a small business in Russia are:

- Income tax on Russian non-tax residents is 30% (13% after 6 months in Russia)

- Tax on any benefits is also 30%

- Directors must reside in Russia full-time

- Social contributions for resident-employees are high

- Learning Russian is tough but must be a priority

- Working with established Russian companies as well as government agencies involves significant of bureaucracy and takes time

- B2B in Russia requires a different mindset and relationships are key

Again, some of these downsides to starting and running a small business in Russia may not even arise in your industry, and others can be dealt with in other ways, but it’s strategically responsible to become aware of them nonetheless. Let’s take a look at the disadvantages in more detail.

30% Income Tax on Non-tax Tesidents

The standard income tax rate in Russia is just 13%. Unfortunately, any foreigner on a regular work visa who works up to 6 months in Russia and then leaves the country must pay income tax at a rate of 30%. However, the good news is that if a foreigner becomes a tax resident by staying in Russia for more than 183 days in a period of 365 days, the foreigner can file for reimbursement of the 17% income tax overpayment with the Russian tax authorities. This doesn’t help temporary workers in Russia much, but for those who stay long-term, they will retain the low, flat 13% income tax rate. It just takes some planning to optimize for your particular situation. If you tend to travel in and out of Russia and cannot claim tax residency, paying yourself the minimum allowable salary and collecting income in the form of dividends as a shareholder at 15% would alleviate much of the tax burden.

30% Tax on Non-cash Benefits

Sometimes it makes sense for companies to offer benefits on top of salaries like a company car, accommodation, or other non-cash benefits. In most cases, a tax of 30% is applied to these benefits as the employee himself benefits from the company’s written-off expenses. On the one hand, a company doesn’t make social contributions on an employee’s behalf if he’s on a regular work visa or has residency, but on the other hand, for a small company to offer additional benefits is financially worth it. If the benefits are substantial, it makes more sense to obtain an HQS visa and be exempt from 1 and 4 above.

Company Director Must Reside in Russia

Every legal entity needs to have a responsible person more or less residing within Russia permanently in order to represent and answer for the company’s business activity. If you wish to run your own small business in Russia and become the director yourself, you need to plan on establishing your domicile in Russia, which means at least 183 days out of the year and consistently being present in Russia. If you know you won’t be living in Russia, then you need to appoint someone who resides in Russia as director to take care of daily affairs.

Thus, your company stays out of trouble when it comes to the Russian authorities requesting inspections. If you’re unsure whether Russia is the place for you to reside permanently, you can always appoint yourself the director, get a work visa and then decide to appoint someone else later. Ideally, you need to decide that before you ever go to Russia by simply visiting with a tourist or business visa.

Social Contributions are High for Residents

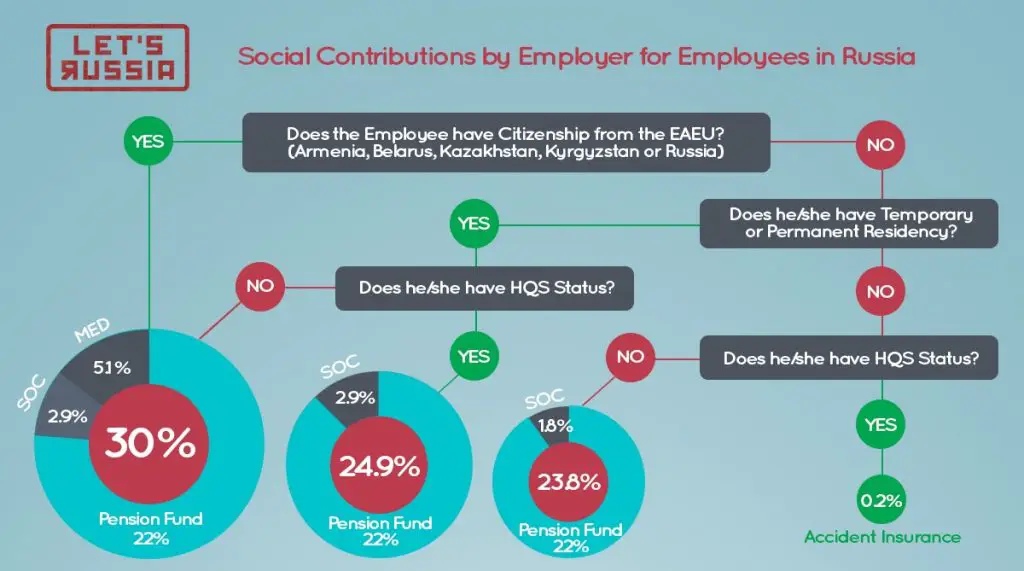

Even though the overall costs of employing people in Russia are lower than in the West, the percentage of social contributions an employer makes on behalf of its employees is quite high by global standards, at least for most low to mid-level employees. Your Russian company will potentially contribute up to 30% of an employee’s salary to the Russian social funds (pension, medical system, etc.) depending on whether the employee has residency in Russia or not. Yes, citizenship and residency status makes a significant difference. An employee with citizenship from Russia, Armenia, Belarus, Kazakhstan, or Kyrgyzstan would cost you 30% on top of an employee’s salary in the form of social contributions.

If your employee happens to be from another country and either has temporary or permanent residency status in Russia or has a regular visa (not a highly qualified specialist), your company shells out between 23.8% and 24.9% to the social funds on top of the employee’s salary. Keep in mind that these contributions are capped out at around 1 million rubles ($13,291) per year so the cost of employing people starts to drop after that point. That doesn’t really change much for your low-level or mid-level employees, however.

Don’t forget that these contributions apply to you too as a foreigner working for your own company. That is, of course, if you take advantage of highly qualified specialist status. Non-residents and highly qualified specialists are exempt from employer social contributions.

Here’s a simple infographic that shows the size of social contributions your Russian company would make based on the status of the employee.

Let’s Russia has a convenient calculator to calculate exactly how much your Russian company would need to contribute to social contributions for any employee based on their citizenship and residence status in Russia. Some advance planning can significantly improve your bottom line and liability for social contributions. If you are interested in talking to a business advisor in Russia, you can contact Let’s Russia (details below) or Expatriant.

Learning Russian is Tough but Worthwhile

As previously mentioned, you can overcome the language barrier through delegation. While this is true, it applies, for the most part, to work-related tasks. There will be many times in your daily life in Russia where knowledge of Russian offers convenience and a sense of self-reliance. Whether it’s when buying groceries, flowers, or taking your car to get an oil change, you’re bound to face situations where you need to communicate in Russian at a basic level. Now, more than ever, you can communicate through smartphone apps and such but you’ll want that human to human interaction.

If you realize a long-term stay in Russia is on the horizon, you need to be able to pass the Russian language test for residency, unless immediate family members have Russian citizenship. Russian is a tough language to learn but it’ll serve you well in the long-run and give you valuable insight into the Russian mentality. For more information on the tests required for a Russian Residence permit, you can check out the Expatriant guide to the exams required for residency permits.

Russian Bureaucracy Slows Things Down

Having done some research about living or doing business in Russia, you may have heard that bureaucracy in Russia is terrible. The fact is, it’s not that great in many countries. If a business plans to thrive, it needs to play by the rules and each industry is governed by slightly different rules and regulations. On the whole, bureaucracy for small businesses in Russia is quite tolerable. In fact, Russia is 28 in the world out of 190 countries for ease of doing business in 2020 according to the World Bank.

You can open a Russian limited liability company within a week, make most payments online, and reports are submitted electronically. Things have come a long way in the last 10 years. However, if your business relies on contracts, collaboration, or certification from government agencies, you need to be patient. A great lawyer is also absolutely essential. You can contact Expatriant if you would like an introduction to an experienced, verified lawyer in Russia.

Nothing is impossible, but that doesn’t mean a particular undertaking will necessarily be worth your efforts or time. We highly recommend that any companies with little experience getting around a specific bureaucratic hurdle seek a professional to facilitate the process. Expatriant has a large network of verified lawyers and professionals in Russia that work with international companies every day. If you need an introduction, you can contact us.

If you do something often enough, hire in-house. If it’s a one-time hurdle, partner with another firm to save your time and nerves. With that said, most small businesses engaged in providing a service or even retail will encounter few impassable obstacles to doing business in Russia.

Russian Mentality and Management Styles

Foreigners who have done business in Russia comment on the difference between the way Russians do business and manage their teams compared to the approach their counterparts take in the West. As mentioned before, negative incentives are not uncommon in Russian companies. Doing business with other Russian companies may turn out to be cumbersome and unreliable at times. Although, in recent years, more and more Russians study abroad and return to Russia to take leadership positions and follow a more Western management style. These companies are usually large and internationally oriented.

One thing you will notice about Russian partners is that they prefer to meet in person to discuss any type of partnership. This is rather customary and, in fact, more of a chance to get a feel for you as a business person to assess how compatible you are as partners. You see, there are numerous practices that Russian companies still engage in to minimize obligations such as tax or social contributions to the Russian government. Some companies indicate minimum salaries officially and then pay the rest in cash to an employee, as one simple example. These are known as “grey schemes” and a potential partner wants to understand whether you operate within the rules or cross the line at all, and in which circumstances.

Many companies keep two versions of their accounting records and only show the one, which is designated for the Russian tax authorities. When two businessmen in the West get together to discuss cooperation, there is an expectation that they both have a certain level of business ethics, morality, and operate within the same boundaries. In which case, there is no need to establish an understanding of boundaries before doing business in the West.

However, that’s not always the case in Russia, especially for small businesses. Russian businessmen blame bloated bureaucracy to justify their actions and, in all honesty, their point of view is understandable. In spite of that, we don’t recommend trying to build a small business in Russia that relies on such practices because it’s not sustainable. Quite frankly, there is no reason to do so because nowadays small businesses in Russia have access to resources they didn’t have in the past. You also need to understand that as a foreigner, you must play by the rules. Russian courts do not look favorably on foreign companies that adhere to shady Russian business practices regardless of how prevalent they are.

Running a Small Business in Russia Remotely

By now, you may have already wondered whether it is possible to run a small business based in Russia from outside of Russia. It is possible to operate your business through a Russian company while residing outside Russia, and the setup does present some advantages worth noting.

You need to appoint either a Russian or foreigner living in Russia as the director of your company to oversee daily operations. As the owner of the business, you will have to be paid via dividends, a salary on a work visa (ideally a highly qualified specialist visa), or a combination of the two. With more and more businesses relying on remote teams, your business in Russia could certainly adapt as well.

The curious thing about Moscow and Saint Petersburg specifically, is that they seem to attract a number of foreigners who end up living in Russia long-term. Among those who go to Russia for short-term assignments or experiences abroad such as teaching English, a surprising number of expats either prolong their stay or stay in Russia indefinitely. For those who earn salaries in euros or dollars, Russia is relatively inexpensive and grants a high standard of living at even average western salaries. You can check out Expatriant’s guide to the cost of living in Moscow to get an idea of what to expect. Many expats have settled in Russia by marrying a Russian and intend to stay.

With all this in mind, you generally have a decent-sized pool of candidates to choose from if you decide to hire expat employees to support your business operating from Russia. There are many more who are prepared to relocate to Russia if given the opportunity. Depending on the business you run, employing a combination of expats and local Russians is a winning solution for many. Expatriant Jobs is the best place to look for potential expat candidates in Russia

Can I Get a Residence Permit in Russia by Opening a Small Business?

You probably don’t want to hear the answer, but… it depends. There are some factors to consider, but in general, yes, it can give you a path to obtaining a residence permit. It mostly depends on your position in a Russian company. If gaining residency in Russia is your main goal, you don’t even have to start a business for that. The easiest way to get residence status by far is to marry a Russian citizen. If that’s not an option, there are other ways. Check out Expatriant’s exhaustive guide on all of the options available. We regularly publish articles about routes to getting a residence permit in Russia. Check out the following guides:

Can I get a Residence Permit by Working in Russia?

Can I get a Residence Permit as a Student in Russia?

Can I Get a Residence Permit in Russia if I Have a Russian Child?

Conclusion

Opening and running a business in Russia as a foreigner without knowledge of Russian is certainly possible. It requires skills that any competent businessperson has already acquired – knowing how to delegate effectively. You can delegate many mundane tasks such as financial and government reporting to your administrative staff, which will significantly alleviate the language barrier.

There are no restrictions when it comes to who can establish a small business in Russia, how much they can own, and in which areas of business they can be involved. The advantages of operating a small business in Russia is that the ongoing costs in most circumstances are outweighed by lower taxes on both the employer and employee than in the West. It does take some effort to learn and understand the Russian mentality, language, and Russian business customs, but they aren’t out of anyone’s reach to pick up. Whether you’re looking to settle down in Russia long-term or looking for an opportunity to cut costs and diversify, Russia may be the perfect place for your small business.

This was a guest post by Marcus Hudson from Let’s Russia. If you would like to contact Marcus and his team about opening a small business in Russia, you can contact them at go@letsrussia.com.